Latest Stats Shed Light On American Spending Habits

DIGITAL ART - FASHION - LIFESTYLE

Published On: January 03, 2021

Americans are not known for their efficient money-spending practices. And the data on this subject pretty much confirm this general perception. Some statistics on American spending habits are outright worrying.

It’s also worth mentioning that even if you’re doing better than an average citizen, there could be room for improvement. Sometimes being slightly “above average” is not enough to lead a financially healthy life.

After all, the “average” person continues to be burdened by financial hardship due to misguided buying and spending habits.

10 Statistics Explains The Spending Habits of Average Americans

It would be an understatement to say that people in the USA have a serious money problem. However, there are some silver linings as well.

Below are some of the US consumer spending statistics of 2021 that paint a good picture of how average Americans navigate their financial lives.

1. American Households On Average Are $145,000 In Debt

17% Off Sitewide Hemden.de Coupon Code

Enjoy a 17% discount across the entire Hemden.de store using this special code—perfect for updating wardrobes with stylish, high-quality clothing at reduced prices.

Upto 95% Off BuyitDirect.ie Discount

Enjoy an incredible opportunity to save as much as 95% on a wide range of premium-quality products available through BuyitDirect.ie, offering unbeatable discounts on electronics, appliances, and more.

30% Off Sitewide Capillus.com Discount Code

Unlock a 30% discount across all items at Capillus.com using the discount code, making premium hair care and wellness solutions more affordable and accessible for everyone.

According to debt.org, the average American family is $90.460 in debt in 2021. Factors such as medical debt, bank loans, credit cards, auto loans, and student loans make up this astonishing figure.

Investopedia estimates that auto loans in particular make up nearly 10% of the overall household debt. Mortgages are the largest component and student loans also play a major role in the overall debt. The total household debt reached $15.24 trillion in the third quarter of 2021 according to the latest Quarterly Report on Household Debt and Credit.

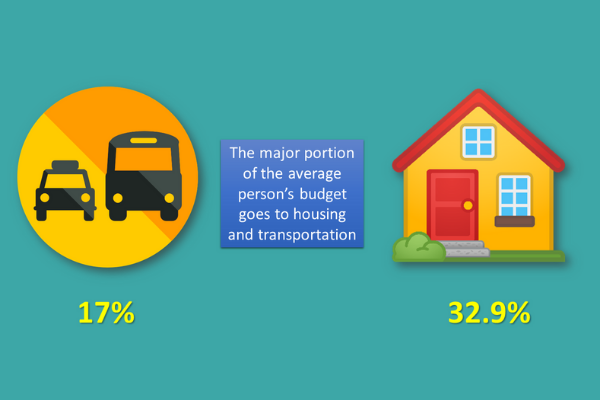

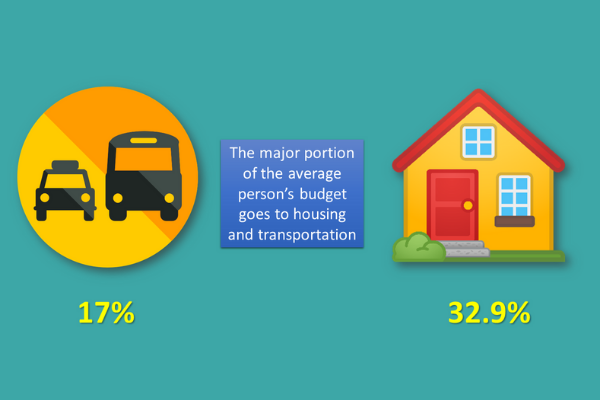

2. 33.1% Of The Budget Goes To Housing

This shouldn’t come as a surprise but the major portion of the average person’s budget goes to housing. According to the Consumer Expenditure Surveys by the U.S Bureau of Labor Statistics, the

average American household spends $19,884 on housing which makes it 33.1% of their budget. Interestingly, transportation also represents a major chunk of the average household spending, being 15.9% of the total budget.

Here’s the US household spending by category:

- 33.1% for housing rents or maintenance.

- 15.9% for transportation.

- 12.9% for food.

- 11.3% for insurance.

- 8.2% for healthcare.

- 5.3% on entertainment.

- 3.1% on clothing

- 2.5% for education.

- 7.5% for others

Among the types of household expenditures,

clothing represents a relatively small percentage. However, Americans can reduce this expense further by using

clothing coupons while buying online.

3. 51% of Americans Have Less than Three Months of Saving

According to a

survey by Bankrate, 51% of Americans have less than three months’ worth of expenses saved in their emergency fund. Meanwhile, 25% of Americans (1in 4 people) have no money saved for emergencies. This is an increase from 21% in 2020. These stats show how much of an impact the pandemic had on an average citizen’s saving ability.

Demographically, younger Americans have fewer savings than their older counterparts. 57% of millennials between the ages between 25 and 40 either have no emergency savings or can’t cover three months’ worth of spendings without any additional income. This holds true for 44% of Gen X and 49% of baby boomers as well. Meanwhile, 30% of baby boomers and 29% of Gen Xers have savings to cover at six months of spending while only 19% of millennials can say the same for themselves.

4. Americans Gave $471.44 Billion in 2020

According to the National Philanthropic Trust, Americans gave $471.44 billion in 2020, which is a 5.1% increase from 2019. Individual citizens contributed $324.10 billion to charity which makes up 69% of the total figure. Charitable giving by an average American has grown over the years.

5. 1 in 5 Americans Didn’t Have a Financial Plan Before the Pandemic

A survey conducted by The Harris Poll found that nearly 1 in 5 American adults didn’t have a financial plan before the pandemic. However, 83% of U.S citizens have either created or revisited their financial plan during the pandemic. Some of the better money-saving habits that Americans have developed are living within their means and avoiding unnecessary spendings. 45% of Americans have made lifestyle changes to get a better grip on their financial situation. This is the major reason consumer spending trends have changed in the last year.

6. Americans Have a Collective Student Debt of $1.73 Trillion in 2021

The Federal Reserve estimates Americans are now more burdened by student debt than ever before. Spread out in 42.9 million borrowers, the overall amount of student debt is $1.73 trillion more than the total U.S credit card debt.

It gets even worse. According to the Education Data Initiative, One in every ten Americans has defaulted on a student loan. 7.8% of all student loan debt is in default.

The student debt crisis is one of the biggest financial calamities taking place in the United States. Those who are under debt should consider adopting effective

money saving strategies to improve their financial health.

7. Unbelievably, 5.4% of American Households Don’t Have Bank Accounts

Maybe, these people don’t have much savings or earnings to store in the bank or they just prefer to stay away from the taxes. But regardless, according to FIDC, 7.1 million American homes don’t have either savings or checking accounts. But the good thing is that this number is clearly declining and is at its lowest since 2019.

8. 20,000,000 Americans Don’t Have Any Mortgage

Amazingly, 20,000,000 Americans own their residences. This is a huge number as it shows that the owners don’t owe any mortgage or bank loans issues. No mortgage makes managing finances 100 times easier. Let’s hope this number continues to grow.

9. Number Of Open Credit Cards Is 365 Million

According to CreditCards.com, 199.8 million credit cards are active in America. This shows that each individual owns at least 10 cards. These cards are both for business and personal uses. Although the usage of cash is on the rise and there are many other online payment solutions available, Americans won’t be throwing away their credit cards any time soon.

10. 40% of Americans Have Engaged In Financial Infidelity

Among every five Americans with combined finances, two have been guilty of committing financial infidelity. This interesting fact has been exposed by the National Endowment for Financial Education. The practice seems to have taken off in the last two years. People have been observed practicing financial infidelity by hiding their credit card, medical, or rent debts from family and spouses.

When you look at how much the average American spends on unnecessary things, the statistics are somewhat frustrating. However, it’s more worrying that people are doing this without the knowledge of their spouse. People committing financial infidelity can get themselves in a lot of trouble. Debts are never a good option as they bring with them stress and anxiety. These potential financial issues can also cause divorce and relationship issues.

Is There A Way Out?

So, what's the solution? Well, you would have to start with the basics. You need to save money and invest it. Create a budget, cut down on unnecessary spendings, and find investment opportunities. In a world of lucrative expenses, households need to gain some learning from the art of spending less and buying more. Some recent

coupon code insights have suggested that millions of people use this method to save money. While you won’t be able to completely transform your financial situations through coupons, they are a good start.

Learn to search and use discount codes when shopping for household possessions, accessories, clothes, and gadgets. Digital coupons cut the price down by a tremendous margin. Some go even as far offering you a 70% off on a product. This opportunity should not be missed under any circumstance.

How Can You Find Coupon Code Online?

- Be active on coupon hosting platforms. These websites have a cumulative drop-down list of coupons of all famous stores.

- Follow your favorite online stores on social media like Facebook, Instagram, and Twitter. You will remain connected with all the discount codes and deals.

- Subscribe to their emails and sign up for notifications.

- Use search engines to type the code and get the link.

Final Words

The stats speak for themselves. There are some good things to note about American spending habits but overall, the situation isn’t that encouraging. One has to be careful in planning the budget and earn accordingly, otherwise, one will drown in something serious. Of course, learning saving techniques and making use of discounts wherever they’re available should also be the priority of American citizens. In any case, the American people need to reevaluate their financial strategy or things will continue to get worse.